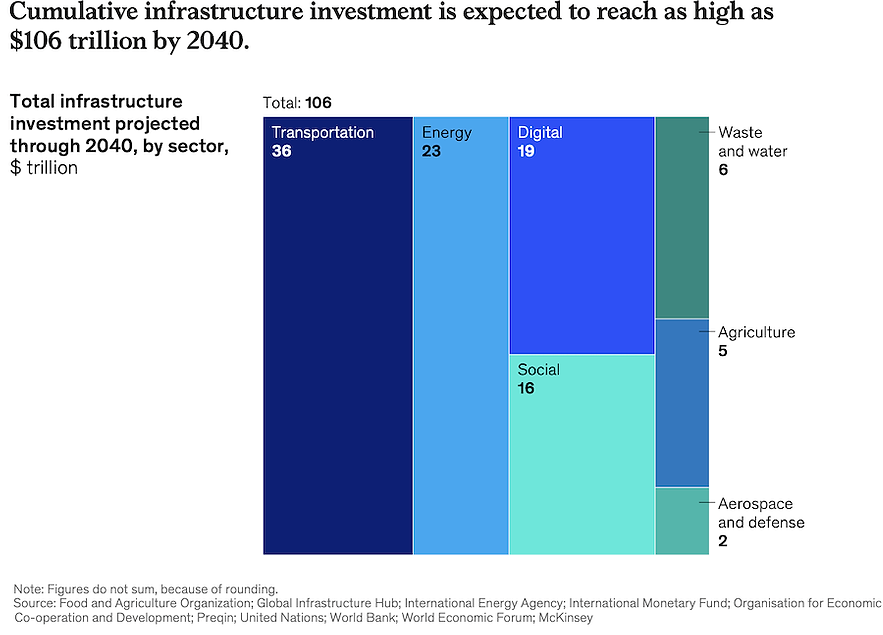

The growth of populations, data centers, AI, electrification, energy transition and urbanization is shaping an estimated $106-trillion infrastructure investment opportunity through 2040 that will increasingly involve private investors, according to researchers at McKinsey and Co.

They emphasize the convergence and intersection of various infrastructure sectors such as water, digital, energy and transportation, and sparking of new business models in a new report released on Sept. 9.

“The definition of infrastructure is changing,” said Alastair Green, a McKinsey senior partner, at the infrastructure summit it hosted in Los Angeles Sept. 9-11. He noted that the definition of infrastructure now includes 100-plus types, falling under seven major verticals: transportation, water/wastewater,

energy, digital, agricultural, social and aerospace/defense with.30% that are relatively new.

The energy transition is a major driver of the need for investment, with countries trying to reach various sustainability goals by 2030 and beyond. In the UK, there is a £12-billion investment in sustainable energy projects, but “we need a £40-billion-plus investment, said Fintan Slye, CEO of its Great Britain-wide power system operator, National Energy System. Steve Powell, president and CEO of Southern California Edison, echoed the push for more investment, saying that $75 billion is needed just for transmission line projects and that Investment in distribution systems must increase tenfold.

“We are behind by almost any measure” in trying to reach sustainability goals, said Gene Gebolys, CEO of World Energy, a global biofuels company. But he expressed optimism that major corporations will not give up on these goals. “They may reposition, but most care about their brand, personal values and mission,” he said.

Experts agreed that the licensing and permitting process for infrastructure projects needs to be streamlined, with Powell noting that a transmission project could take up to 20 years despite the actual construction only taking a few.

Geopolitical uncertainty is another factor posing challenges. The pandemic, global warfare and current U.S. administration have contributed to “a reversal of foundations that we once took for granted, such as free trade,” said Christopher Frost, senior managing director at Macquarie Asset Management. For three decades until now, “relatively benign interest rate environment, rules-based international order and a belief that infrastructure is essential to economic growth provided a constructive environment for this asset class,” he said.

Jonathan Elkind, senior advisor at WestExec Advisors and former U.S. Dept. of Energy assistant secretary for international affairs, also noted “uncertainty around legal structures that were once thought to be beyond question.” He cautioned that “ill-considered change can be dangerous and chilling to investment.”

However, infrastructure investment continues to be a “low risk, low return” asset class, said Frost. Luba Nikulina, chief strategy officer for IFM Investors, noted that its recently released report finds that infrastructure remains a “trajectory of interest” with investors’ expectations of return on invewtment greatly increased in a year.

That private-sector interest is vital to meet infrastructure needs. “We are desperate for a diversification of funding,” said Jamie Torres-Springer, president of the New York City Metropolitan Transportation Authority’s Construction & Development unit. He said the agency is interested in potential public-private partnerships for projects such as the planned redevelopment of an old freight line into a transit line connecting Brooklyn and Queens, adding “we have moved heavily into design-build and incentivizing schedules” for contractors.

Shailen Bhatt, senior vice president and chief operating officer for the U.S., Latin America and Minerals & Metals business of AtkinsRealis and former Federal Highway Administration chief, suggested that private-sector companies may even embed with public agencies on projects. “Take the politics out of infrastructure and fix the procurement process” for implementing new technologies,” he added.

Private partners such as utility company Dominion Energy are indeed working with public entities in Virginia and South Carolina, said Carlos Brown, executive vice president with Dominion. “The developer has to be open … what’s the end goal? What are the non-negotiables?” Then, don’t be constrained by traditional models, he said.

“It’s not about the solution; it’s about the purpose” of the infrastructure project, said Nick Harris, CEO of National Highways in the U.K., which plans to start construction of the 14.5-mile Lower Thames Crossing pair of tunnels next year. Thoughtful purpose of a project in serving the community via economic development, environment, inclusion or other positive goals can help a project survive ever-changing political cycles, he said.

In Australia, while the focus is shifting from transportation megaproject to energy transition projects, “projects will need to tick a lot of boxes,” said Adam Copp, CEO of Infrastructure Australia. Echoing the McKinsey report’s theme of interconnections among infrastructure, he noted that no matter the main emphasis of a project, it will need to address other issues such as housing, manufacturing, decarbonization and knowledge-sharing.

Brown concurred: In the coming years, “a lot of dirt will fly … [and projects] will be more inclusive than ever.”