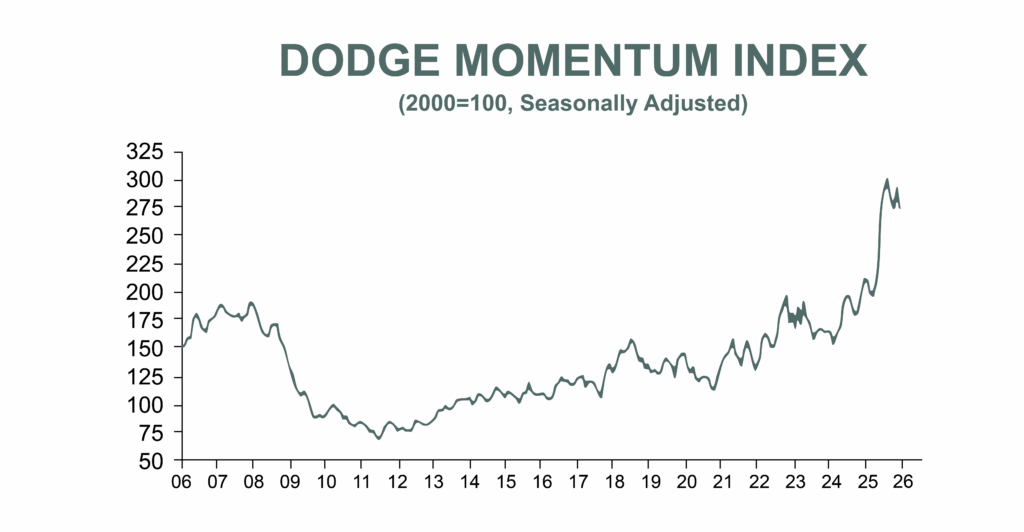

Nonresidential construction planning slipped 6.3% month to month in January due to weaker commercial and institutional activity, essentially erasing a gain from the end of 2025, according to the Dodge Momentum Index.

Despite the overall pullback, data centers maintained their upward trajectory.

“Planning momentum cooled in January across most commercial and institutional sectors,” said Sarah Martin, associate director of forecasting at Dodge Construction Network. “Data center projects continue to lead the way, but after elevated activity in late 2025, most nonresidential sectors are now easing into a more sustainable growth pattern.”

The planning figures, which lead actual construction spending by a full year, showed a 7.2% and 4.4% month-to-month drop in commercial and institutional planning, respectively.

Nevertheless, the index still shows 26% annual growth for commercial projects and 34% for institutional projects, compared to January 2025. The overall index is up 29% year over year, and hit a record high in July 2025. It has descended modestly since then from its most recent zenith.

Zooming in, it was data center construction that largely propped up overall planning figures in 2025. January’s report showed more of that same trend. In fact, the top three projects valued at $100 million or more to enter planning in January were data centers, according to Dodge.

Aside from that strength, however, momentum is subdued for other construction projects.

For example, planning activity in January slowed month to month across nearly all commercial segments, including office, warehouse and hotel projects. Figures did improve to start the year for retail construction, according to Dodge.

Institutional planning, on the other hand, largely ticked down in January due to slowdowns in education, healthcare and public building plans. Recreational and religious building projects continued to expand.

- The $500 million IEP Data Center in Monongahela Township, Pennsylvania.

- The $400 million Mountain Road Technology Park Data Center in Glen Allen, Virginia.

- The $350 million Bitfarm Data Center in Nesquehoning, Pennsylvania.

The largest institutional projects to enter planning included:

- The $250 million USACE Barracks in Fort Hood, Texas.

- The $175 million UEPH Barracks at Joint Base Myer-Henderson in Arlington, Virginia.

- The $148 million Eurofins Lancaster Biopharmaceutical Laboratory and Office Building in Lancaster, Pennsylvania.