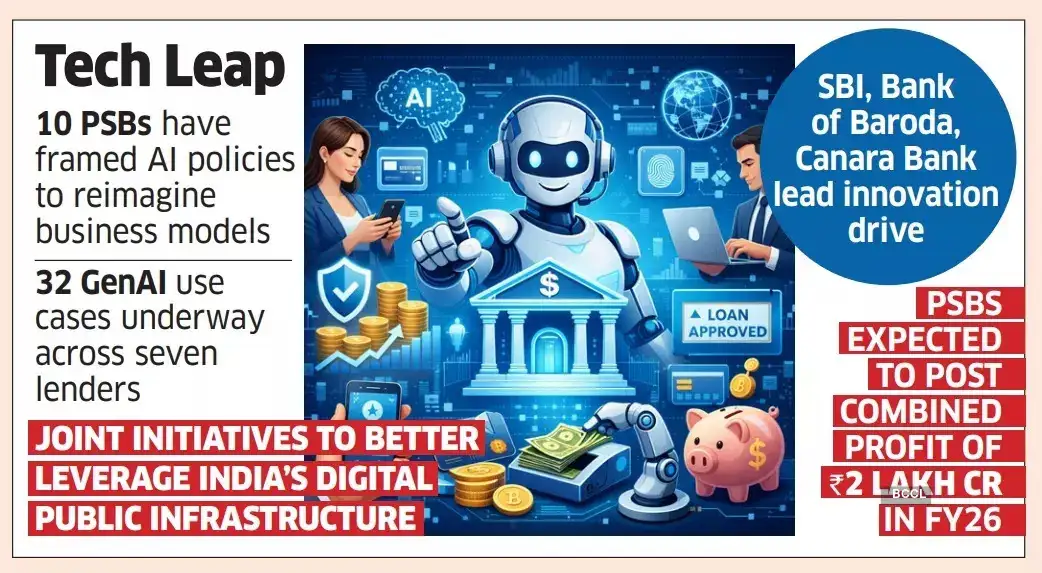

Also, ten PSBs have framed formal AI policies, with the latest reform round encouraging adoption of agentic AI to automate complex workflows and enable faster, data-driven decision-making.

“These GenAI-based capabilities are helping lenders make informed and faster decisions during credit appraisal, covering key areas like business overview, financial analysis, credit history, and repayment track record,” said a senior bank executive. At least seven lenders have already deployed one or more GenAI use cases, the executive said.

The Enhanced Access and Service Excellence (EASE) reforms – steered by the Department of Financial Services (DFS) – are designed to modernise state-run lenders through governance, technology and risk-management upgrades. Under EASE 8.0, banks are focusing on strengthening credit monitoring frameworks across portfolios and building digital underwriting capabilities to reduce turnaround time and improve asset quality.

In the latest internal review, around nine PSBs reported deploying digital solutions for comprehensive operational risk management, a second bank executive said.

Live Events

Almost all state-run lenders currently have standard operating procedures for Expected Credit Loss (ECL) computation that leverage at least one full economic cycle of historical data along with macroeconomic projections – a move seen as aligning risk assessment practices more closely with global standards.

The reforms come as banks seek to sustain improvements in asset quality while preparing for potential global volatility. Officials said technology-led underwriting and monitoring tools are enabling early detection of stress signals and more granular portfolio tracking.The next phase of reforms, branded EASErise for 2025-26, will focus on fortifying risk-management systems, enhancing the ability of PSBs to absorb economic shocks and safeguarding financial stability.

“We have shared these details with the government’s plans for EASE 9 are being firmed up,” the second executive said, adding that the AI-led initiatives have already contributed to stronger portfolio quality and greater resilience against credit shocks.

The technology push aligns with the Centre’s broader financial-sector vision articulated at last week’s two-day ‘Chintan Shivir’ convened by the finance ministry with banks and financial service providers. The discussions centred on banking transformation, cyber security, financial inclusion, and the goal of building a fully insured and pensioned society by 2047 under the Viksit Bharat roadmap.

In a statement, the ministry said the deliberations reaffirmed that the future of Indian financial institutions will be defined by “bold ambitions and transformative purpose”, with PSBs and public financial institutions expected to play a central role in advancing national priorities and emerging as institutions of global standing.

As the reform cycle progresses toward EASE 9, officials indicated that the emphasis will remain on deepening digital integration, scaling AI applications across customer service and credit functions, and ensuring that innovation is matched by robust governance safeguards.