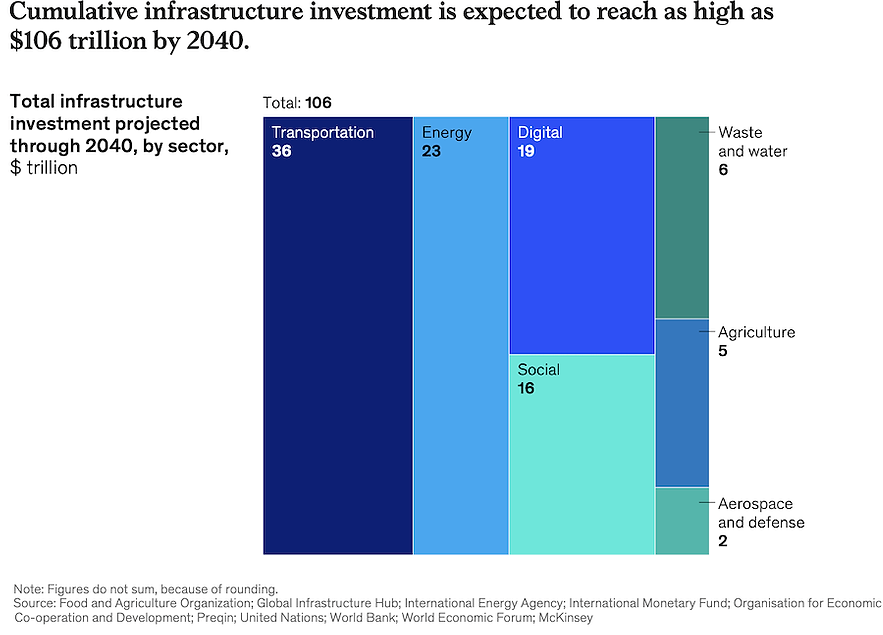

The growth of populations, data centers, AI, electrification, energy transition, and urbanization are all key reasons that infrastructure represents a $106-trillion investment opportunity from 2024 to 2040, according to researchers at McKinsey and Co.

The firm released a report on Sept. 9 emphasizing the convergence and intersection of various sectors such as water, digital, energy and transportation, and the consequent sparking of new business models that will increasingly involve private investment.

“The definition of infrastructure is changing,” said Alastair Green, a McKinsey senior partner, at the infrastructure summit it hosted in Los Angeles Sept. 9-11. He noted that the definition of infrastructure now includes 100-plus types, 30% of which are relatively new. They fall under seven major verticals: transportation, water/wastewater, energy, digital, agricultural, social and aerospace/defense.

The energy transition is a major driver of the need for investment, with countries across the world trying to reach various sustainability goals by 2030 and beyond. In the UK, there is a £12-billion investment in sustainable energy projects, but “we need a £40-billion-plus investment, said Fintan Slye, CEO of the National Energy System. Steve Powell, president and CEO of Southern California Edison, echoed the need for more investment, saying that $75 billion is needed just for transmission line projects; investment in distribution systems need to increase tenfold, he said.

“We are behind by almost any measure” in trying to reach sustainability goals, said Gene Gebolys, CEO of World Energy, a global biofuels company. But he expressed optimism that major corporations will not give up on these goals. “They may reposition, but most care about their brand, personal values and mission,” he said.

Panelists agreed that the licensing and permitting process for infrastructure projects needs to be streamlined, with Powell noting that a transmission project could take up to 20 years despite the actual construction only taking a few.

Geopolitical uncertainty is another factor posing challenges. The pandemic, global warfare and the current U.S. administration have contributed to “a reversal of foundations that we once took for granted, such as free trade,” said Christopher Frost, senior managing director with Macquarie Asset Management. For three decades until now, “relatively benign interest rate environment, rules-based international order and a belief that infrastructure is essential to economic growth provided a constructive environment for this asset class,” he said.

Jonathan Elkind, senior advisor with WestExec Advisors and former Assistant Secretary for International Affairs with the U.S. Dept. of Energy, also noted the “uncertainty around legal structures that were once thought to be beyond question.” He cautioned that “ill-considered change can be dangerous and chilling to investment.”

However, infrastructure investment continues to be a “low risk, low return” asset class, said Frost. Luba Nikulina, chief strategy officer with IFM Investors, noted that its recently released report finds that infrastructure remains a “trajectory of interest” with investors’ expectations of ROI greatly increased in a year.

That private-sector interest is vital for meeting infrastructure needs. “We are desperate for a diversification of funding,” said Jamie Torres-Springer, president of the New York City Metropolitan Transportation Authority’s Construction & Development arm. He said the agency is interested in potential public-private partnerships for projects such as the planned redevelopment of an old freight line into a transit line connecting Brooklyn and Queens, and that “we have moved heavily into design-build and incentivizing schedules” for contractors.

Shailen Bhatt, CEO of AtkinsRealis and former Federal Highway Administration chief, suggested that private-sector companies may even embed with public agencies on projects. “Take the politics out of infrastructure,” he added, and “fix the procurement process” for implementing new technologies.

Private partners like Dominion Energy are indeed working with public entities such as Virginia and South Carolina, said Carlos Brown, executive vice president with Dominion. “The developer has to be open … what’s the end goal? What are the non-negotiables?” Then, don’t be constrained by traditional models, he said.

“It’s not about the solution; it’s about the purpose” of the infrastructure project, said Nick Harris, CEO of National Highways in the U.K., which is planning to start construction on the 14.5-mile Lower Thames Crossing pair of tunnels next year. Thoughtful purpose of a project in serving the community via economic development, environment, inclusion or other positive goals can help a project survive ever-changing political cycles, he said.

In Australia, while the focus is shifting from transportation megaproject to energy transition projects, “projects will need to tick a lot of boxes,” said Adam Copp, CEO of Infrastructure Australia. Echoing the McKinsey report’s theme of interconnections among infrastructure, he noted that no matter the main emphasis of a project, it will need to address other issues such as housing, manufacturing, decarbonization, and knowledge-sharing.

Brown concurred: In the coming years, “a lot of dirt will fly … [and projects] will be more inclusive than ever.”